Hello friends in today's post I am going to explain about Insta loan and Insta Jumbo loan from HDFC how to take them? and which one will be better for you?

So without any further ado let's get started:-What is Insta Loan?

Insta loan from HDFC is a pre-approved loan on HDFC credit card. which means you don't have to do anything to take the loan it will shown itself on the section of your net banking without needing any documents.- Credit card limit will get block from your credit card for the amount you will take the Insta Loan.

- You will have to pay the GST on the interest rate per month.

- Limit for Insta Loan is within the credit card limit.

- Monthly EMI statement will show with your credit card statement as in normal cases

How to take Insta Loan?

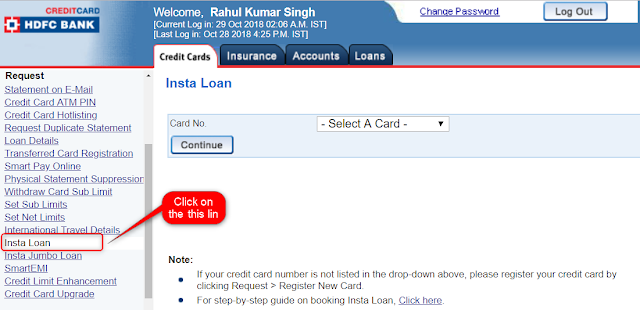

For this you must be a HDFC credit card holder and you should be eligible for this and if you are -you can check this by going to following section in your HDFC credit card net banking as shown in the below screenshot:-Click on the link Insta Loan from the left or follow below screenshot in which I have shown by login to my account:-

Then select the card no. on which you would like to take the Insta Loan as shown below:-

Once selecting the card you will see the below shown interface on which you can see all the details related to it like credit limit you have or the interst charge on the loan and the tenure for which you would like to take the loan. as well as the amount that you would like to take.

Choose the below shown field as per your need and you are done with it.

Now coming to Insta Jumbo loan and what are the advantage of Insta Jumbo on the Insta loan:-

What is Insta Jumbo loan?

Insta Jumbo loan is pre approved loan on the HDFC credit card on which your credit limit generally remains above your credit card limit.

- Credit card limit will NOT get block from your credit card for the amount you will take the Insta Jumbo Loan.

- No need to pay the GST on the interest rate per month.

- Limit for Insta Loan is ABOVE the credit card limit.

- Monthly EMI statement will be sent seperately and the payment process is also different for paying the Insta JUmbo loan EMI follow below link:-

How to take Insta Jumbo Loan?

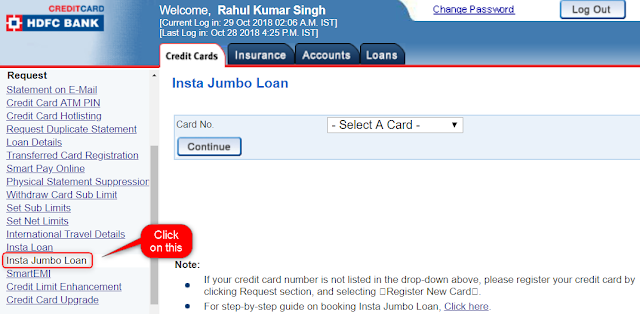

You can take it going to below section of your HDFC net banking:-

As shown click on the left on the link Insta Jumbo Loan and you can see the below interface.

Now select the card as previously shown in the case of Insta Loan as shown below:-

Now you can see all the details related to it like the limit you are allowed in my case I have already taken Insta Jumbo loan that's why this time my limit is less as compared to Insta loan but in rest cases it will always be greater than Insta loan as Insta loan limit is within the card limit and Ista Jumbo loan limit is above the card limit:-

What is the difference between Insta Loan and Insta Jumbo loan?

Below shown is the main difference between them this screen shot is taken from the HDFC official website and you can see clearly which suits you if not I will explain you below:-

Which Loan is better Insta Loan or Insta Jumbo Loan?

If you are eligible for the Insta Jumbo loan then this will be your best option as shown in the above difference it is clear that in Insta Jumbo loan your credit card limit does not get blocked but in the case of Insta Loan it will. Another benefit of taking Insta Jumbo Loan over Insta Loan is in the Insta JUmbo loan you do not pay GST on the interest that you pay on the monthly basis but on the Insta Loan you will have to pay.

Another major benefit is in the Insta Jumbo loan interest rate is also low as compared to Insta JUmbo loan.

In which scenario one should take Insta Loan over Insta JUmbo Loan?

The only reason I can see someone opting for the Insta Loan is they are not eligible for the Insta JUmbo loan as INsta Jumbo loan need higher CIBIL score for you to become eligible for this.

If you are not eligible for this and you would like to increase your CIBIL score follow below link for the detailed result:-

I think I have covered the differences between the Insta Loan and Insta Jumbo loan and if not you can comment below and ask for it.

Happy reading!!

No comments:

Post a Comment