You have a credit card and the issuer is Standard Chartered Bank, you have to make a big purchase on your credit card or you have already made a purchase and you are worried that how you are gonna pay that amount in your upcoming billing date.

Don't worry I will try to explain a way with which you can pay your big amount in smaller chunk, of course it will attract charges but we know we do not have other option.

so let's dive into it.

If you are a Standard Chartered credit card holder and assuming that you are eligible for the Kuch Bhi On EMI facility as in most cases everyone are; you can follow the below given steps and you escape yourself from paying the big amount in one go instead you can pay them in your preferred tenure in monthly installment.

What is Kuch Bhi on EMI? and how it is different from personal loan?

Kuch Bhi on EMI let's you convert your big spent of credit card that you have to pay on the next billing date to smaller EMI so that you can pay them easily as your convenience without any hassle.

It is different from personal loan in the sense that it is not a standalone feature it means it is associated with your credit card and can only be taken on the credit card purchase and for and on the eligible amount and on eligible transaction.

Now let suppose I have made a transaction of 4000 RS this month and I don't want to pay this amount on the next billing date then what I can do is I can dial a EMI by looking at current interest rate charges by the bank and choosing the preferred tenure and if successfully done bank will credit my amount of 4000RS to my card instantly and convert the amount 4000 to EMI as per the interest rate and applicable GST a similar demo is shown below by taking example of Standard chartered net banking interface.

1. Login to your netbanking and click on the link Kuch Bhi on EMI as shown below:-

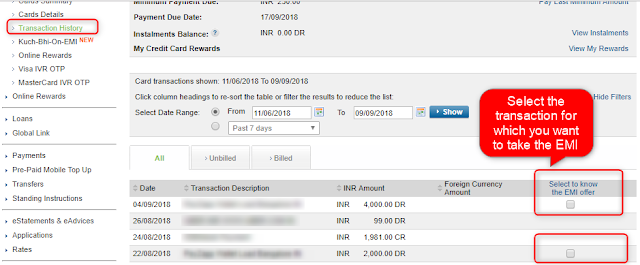

Now clicking on the above link will navigate you on your transaction history as shown below:-

Now you can select the transaction on which you want to make as EMI or you can select multiple transaction as your wish as shown above I am selectin transaction of 4000 RS to make it EMI

Now after selecting and clicking next you will be navigated to below shown screen:-

Here you can select the Tenure as shown above and see for the interest rate charges by the bank and then note down your EMI amount make mind that this is the amount you need to pay every month so this way multiplying this EMI amoount to your selected tenure you can see the extra cost associated with the EMI as shown above in my case it is 363*12 = 4356 and GST on the interest as well as you will have to pay a processing fee that you can see there.

So this is the overall amount you have to pay. Now once you submitt the EMI process within 2-4 days you will be allocated with a different card number as shown below for paying the amount of EMI you have to pay to this card number that is different from actual credit card number you can get the idea from below shown screenshot:-

In the above clip you can see two card number one is actual credit card nymber and other is named as InstaBuy Executive this is the one you are currently concerned about.

Now the question arises:-

How to pay your Kuch Bhi on EMI installment?

as shown below you have to go to Payments link on the left and select your EMI card no. as shown below:-Selecting this with payment from other bank account option will navigate you to below shown bill desk interface and from here you have to choose Card loan account as shown below:-

4. Now when

Enter the Instabuy Executive card number here and pay the bill after that everything is self explanatory.

Hope I helped you some way. Please Subscribe to my blog and comment for any query.

No comments:

Post a Comment